AI Hype’s Wearing Off—And Revenue Targets Are Paying the Price

We need to talk about the awkward thing happening in boardrooms right now: companies are spending like crazy on AI… and still missing revenue targets like it’s a hobby.

If you’ve felt that “wait, didn’t we buy three AI platforms and rename half the team to ‘AI something’?” whiplash, you’re not alone. The hype wave is breaking, and what’s left is a credibility problem—especially in revenue orgs.

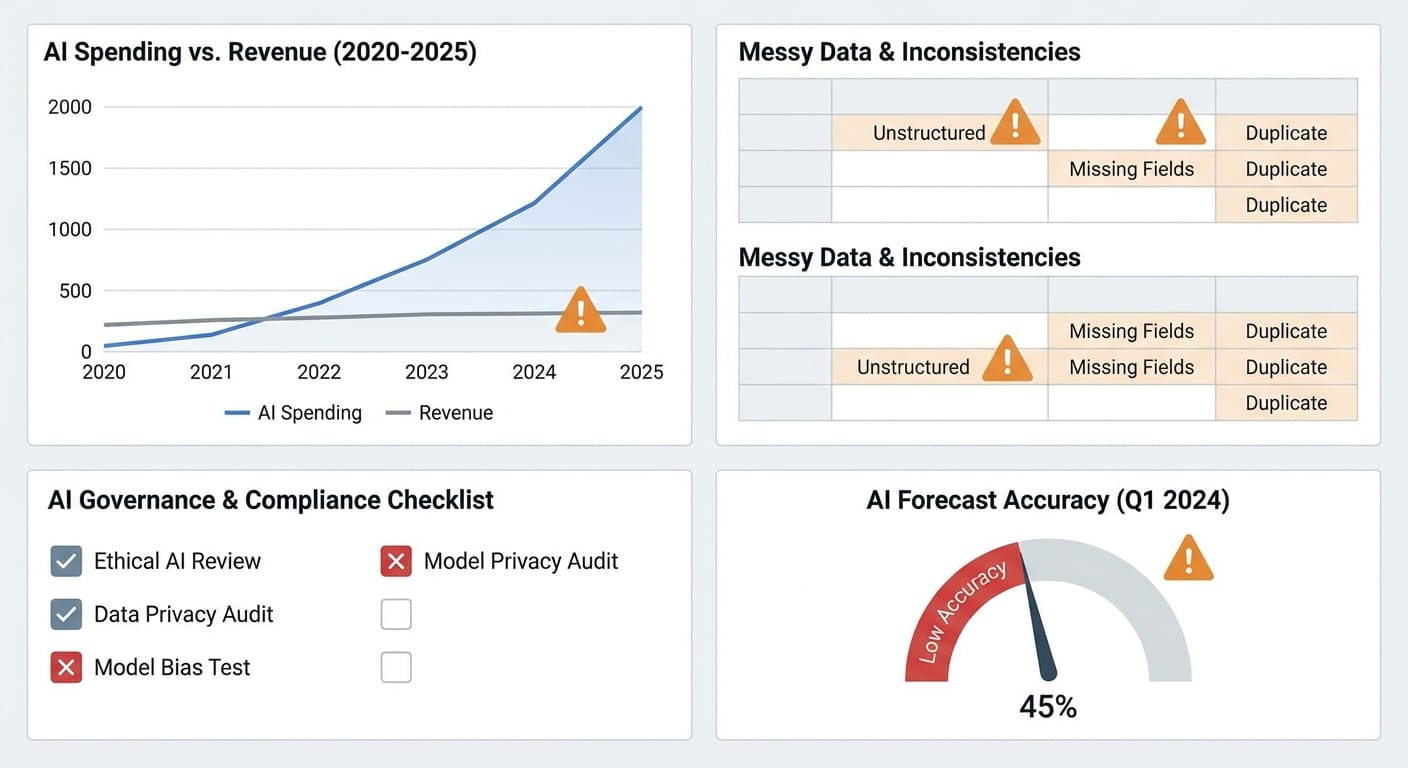

The AI-revenue gap isn’t a vibe. It’s math.

Here’s the stat that should make every exec spit out their coffee: 87% of enterprises missed their 2025 revenue targets despite record AI spending—based on Clari Labs research surveying 400 CIOs, CROs, and RevOps leaders in large North American enterprises [1].

So what happened? Did AI “not work”? Sort of. But mostly, companies did the classic thing: they bought the fancy sports car before paving the driveway.

Clari’s data points to the real culprit: 48% say their revenue data isn’t AI-ready, and 42% don’t have formal governance frameworks to keep data accurate and controlled [1].

Translation: you can’t sprinkle machine learning dust on top of broken pipelines, inconsistent CRM hygiene, and “forecasting by vibes” and expect the magic to happen.

“But we invested a ton!” (Yeah… that’s part of the problem)

There’s also a bigger pattern here that I think the market is finally getting honest about. MIT research found that in 2025, 95% of organizations reported zero ROI on generative AI projects [3]. Zero. As in: the project shipped, the demo looked great, and the business result… wandered off into the woods.

And yet (because of course), global AI spend is projected to hit $2.5 trillion in 2026, up 44% from 2025, even while Gartner’s calling this phase the “Trough of Disillusionment”—where interest drops as implementations fail to deliver [3].

This is the part where I’ll take a stance: we’re not “early” anymore. If you’re still using “it’s new” as an excuse for no measurable outcomes, your AI program is basically a science fair project with a bigger invoice.

The other half of the mess: revenue targets built on optimism

AI isn’t the only thing getting ahead of reality. Revenue planning is too.

Organizations are planning for 8.2% average revenue growth in 2026—a pretty optimistic jump right after a year where many companies missed similar goals [2] [4].

Revenue Management Labs puts it bluntly: “Targets are rising faster than execution is changing.” [2] [4]

And when that happens, here’s what I see every time (I’ve lived this movie):

- Sales teams stop believing the number (they might still chase it, but belief is gone)

- Forecasts get worse because people sandbag or “manage optics”

- Pricing becomes the crutch—raise prices and pray, instead of fixing execution [4] [6]

It’s like promising you’ll lose 20 pounds this month, buying a smart scale, and then… not changing your diet. The scale wasn’t the problem.

So where does AI actually deliver value? (Spoiler: not where everyone started)

Most enterprises tried to use AI like a battering ram: automate outbound, crank volume, “personalize” at scale, and brute-force pipeline.

Buyers hated it. Reps hated it. Spam filters definitely loved it.

The smarter play—and the research supports this—is to use AI more like a mechanic’s diagnostic tool. Start with fundamentals: pricing governance, forecast hygiene, and clean revenue data.

Revenue Management Labs highlights that organizations with strong pricing governance, regular review cycles, and clear cross-functional accountability are more likely to close the gap between targets and results [4].

Another area where AI is legitimately useful right now: inbound discovery and enablement. As search behavior shifts toward AI assistants like ChatGPT and Grok, the game is less “blast more outreach” and more “be the best answer when buyers ask the question.” That means tightening your content, structuring expertise, and making your insights easy for humans and machines to find [5].

My hot take: outbound automation is the “fast food” of AI GTM—cheap dopamine, expensive long-term health. Inbound + enablement is the “meal prep” approach. Less flashy, way more effective.

The governance problem nobody wants to own

Here’s the part that bites: most AI initiatives are IT-led, and revenue teams are passengers.

Clari found that while 91% of IT teams lead AI training and data preparation, only 29% of RevOps teams are top contributors [1]. That’s basically building a revenue brain without the people who understand revenue anatomy.

Also, only 39% of organizations recalibrate forecast models weekly or monthly, meaning most companies are running predictions on stale assumptions [1]. Imagine using last quarter’s weather forecast to plan next month’s outdoor wedding. Same energy.

What good looks like (and yes, it’s possible)

When revenue data is unified and governed, the outcomes get… kind of insane.

Forrester analysis (as cited in the Clari research) reports enterprises with unified, governed revenue data achieved:

- Up to 96% forecast accuracy

- Renewal rates up by 20 points

- 398% ROI and $96.2M in realized benefits over three years [1]

Notice what’s doing the work there: not “AI magic.” It’s disciplined revenue operations plus AI layered on top.

What I’d do if I were you (practical, not theoretical)

If you’re an exec, RevOps leader, or a sales leader trying to survive 2026 planning season, here’s how you stop the bleeding and start earning trust again:

1) Stop funding AI projects that don’t touch a revenue metric

Pick 2–3 metrics max. Examples:

- Forecast accuracy (by segment)

- Cycle time

- Renewal rate / net retention

- Win rate in a specific ICP

If the project can’t move one of those, it’s not a revenue AI initiative. It’s experimentation. That’s fine—just don’t forecast miracles.

2) Make RevOps a co-owner of AI (not a downstream “user”)

IT should not be the only grown-up in the room. RevOps owns definitions, pipeline stages, attribution logic, and forecasting cadence. If RevOps isn’t designing the system, you’re going to automate the wrong things faster.

3) Fix data governance before you “scale” anything

Unsexy advice that works:

- Agree on one definition of pipeline, one definition of “commit,” one definition of “qualified.”

- Enforce mandatory fields where it matters (not everywhere).

- Audit CRM hygiene weekly until it stops being a dumpster fire.

4) Re-forecast more often (your market isn’t waiting for QBR)

If only 39% are recalibrating monthly or weekly [1], there’s your opportunity. Tighten the feedback loop. Forecasting is like GPS—if you don’t reroute, you’ll confidently drive into a lake.

5) Use AI where buyers actually feel it: inbound, enablement, and pricing discipline

Shift effort from “spray and pray outbound” to:

- Better answers in AI-powered search

- Faster rep ramp (coaching, call insights, objection handling)

- Pricing governance and deal desk consistency

These are compounding advantages. And they don’t require you to bet the company on a chatbot.

Actionable takeaways (do these this quarter)

- Run a 30-day revenue data readiness audit (CRM fields, definitions, governance gaps). If your data isn’t AI-ready, admit it and fix it.

- Pick one forecasting cadence upgrade (weekly recalibration for one segment is enough to start).

- Kill or pause one “AI for AI’s sake” project and reallocate that budget to data governance + enablement.

- Move AI effort toward inbound discovery: refresh your highest-intent content so your expertise shows up where buyers now search.

AI isn’t dead. But the era of “we bought AI, therefore growth” is over. The winners in 2026 will be the teams that treat AI like power steering—not a substitute for having an engine.

Sources: Clari Labs enterprise revenue and AI readiness research [1]; Revenue Management Labs commentary on target setting and execution gaps [2] [4]; MIT Sloan/related MIT research on genAI ROI and Gartner Hype Cycle concept [3] [3]; broader shift toward AI-assisted search and discovery platforms [5]; pricing-as-growth pressure discussed in revenue planning analysis [6].